How has the crypto industry been impacted by cyber threats, with a reported loss of $2.3 billion in 2024 according to Cyvers Report?

Dec 22, 2024The cryptocurrency industry faced a surge in cyber threats in 2024, with losses exceeding $2.3 billion. This article explores the impact of these threats and the need for enhanced security measures.

The cryptocurrency industry faced a significant surge in cyber threats in 2024, culminating in a staggering loss of over $2.3 billion, as reported by Cyvers. This substantial financial damage underscores the persistent vulnerabilities within the crypto ecosystem and highlights the urgent need for enhanced security measures. This article will explore the multifaceted impact of these cyber threats on the crypto industry cyber threat impact, $2.3B loss 2024, drawing insights from various reports and incidents.

The Mounting Scale of Crypto Losses in 2024

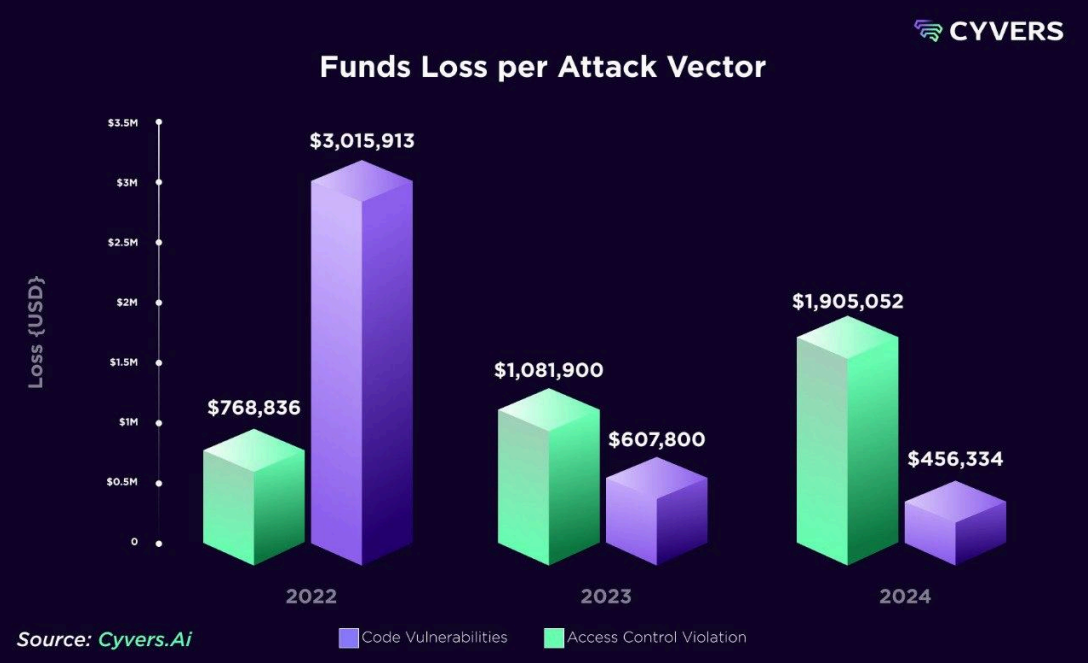

The year 2024 witnessed a concerning rise in cryptocurrency-related hacks and frauds, resulting in losses exceeding $2.3 billion across 165 separate incidents. This figure represents a 40% increase compared to the previous year, although it is lower than the $3.7 billion lost in 2022. This indicates a continuous and evolving threat landscape, where the industry's defenses struggle to keep pace with the sophistication of attacks. Notably, these losses aren't just about the numbers; they represent real financial harm to both individuals and institutions involved in cryptocurrency.

Credit: beincrypto.com

Credit: beincrypto.com

Access Control Vulnerabilities and Ethereum's Exposure

A significant portion of these losses can be attributed to access control vulnerabilities, which accounted for 81% of the total funds stolen. While these incidents made up 41.6% of the total cases, their outsized impact reveals the severe risks associated with mismanaged security protocols. Ethereum, in particular, was the most affected blockchain, recording losses exceeding $1.2 billion. This highlights the need for robust and well-implemented access control mechanisms in the crypto space.

The Rise of "Pig Butchering" Scams

Another disturbing trend in 2024 was the proliferation of "Pig Butchering" scams, which defrauded unsuspecting users of over $3.6 billion, largely on the Ethereum blockchain. These elaborate fraud schemes illustrate the evolving tactics employed by cybercriminals, showcasing their adaptability in exploiting user trust and technical vulnerabilities.

Key Attack Vectors and Vulnerabilities

Several attack vectors contributed to the substantial losses in the crypto industry cyber threat impact, $2.3B loss 2024. These included:

- Smart Contract Vulnerabilities: Flaws in smart contracts, particularly in Decentralized Finance (DeFi) platforms, were heavily exploited. These vulnerabilities allowed attackers to drain funds, highlighting the critical importance of rigorous auditing and security testing of smart contracts.

- Private Key Compromises: A significant number of attacks involved the compromise of private keys, leading to unauthorized access and theft of funds. This underscores the vital role of secure key management practices, especially for centralized platforms.

- Phishing: Phishing attacks remained a prevalent method, with attackers tricking users into divulging sensitive information or transferring funds to malicious addresses.

- Multi-Chain Attacks: Cross-chain operations presented new attack surfaces, where hackers drained assets across multiple networks, exploiting vulnerabilities in the bridging mechanisms.

Credit: beincrypto.com

Credit: beincrypto.com

Quarterly Distribution of Losses

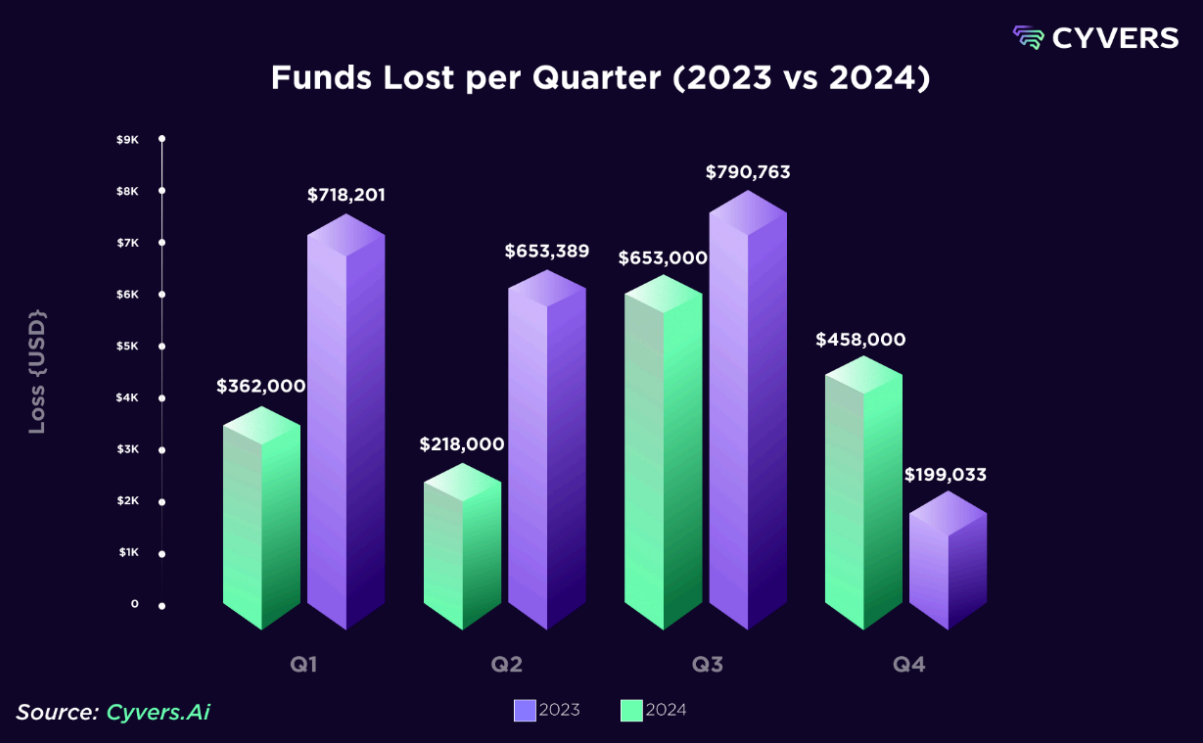

The third quarter of 2024 was the most devastating, with $790 million stolen during this period. In contrast, the fourth quarter saw a significant reduction in malicious activity, suggesting a temporary lull in operations. This fluctuation highlights the dynamic nature of cyber threats in the crypto space, requiring ongoing vigilance.

Credit: beincrypto.com

Credit: beincrypto.com

Major Crypto Hacks of 2024: Case Studies

Several high-profile hacks in 2024 serve as stark reminders of the industry's vulnerabilities:

- WazirX Hack: The Indian crypto exchange WazirX suffered a $234.9 million loss in July due to vulnerabilities in its multisignature wallets. This incident demonstrated that even seemingly secure systems can be susceptible to exploitation if not properly implemented and maintained.

- Radiant Capital Attack: The blockchain lender Radiant Capital lost over $50 million in a multi-chain attack in October. Hackers gained access to private keys, highlighting the risks associated with cross-chain operations and the need for better key management.

- DMM Bitcoin Incident: The Japanese cryptocurrency exchange DMM Bitcoin faced a devastating loss of approximately 4,502.9 Bitcoin (valued at $320 million at the time) after attackers compromised a private key. This led to the exchange's closure in December, underscoring the catastrophic impact of inadequate key security.

The North Korean Connection

Notably, crypto hacking linked to North Korea more than doubled to a record high of $1.3 billion in 2024. This highlights the involvement of sophisticated state-sponsored actors in cybercrime, seeking to circumvent international sanctions through cryptocurrency theft.

The Role of Centralized Platforms (CeFi)

Centralized financial platforms (CeFi) continue to be attractive targets for attackers due to their single points of failure, such as centralized reserves and insufficient oversight of key management. The reliance on multisignature wallets, which have proven vulnerable under certain conditions, further exacerbates these risks.

Emerging Threats and Future Challenges

The advent of emerging technologies, including quantum computing and artificial intelligence, is expected to intensify cyber threats by enabling increasingly complex attack methods. This necessitates proactive security measures to keep pace with the dynamic threat landscape.

Addressing the Cyber Threat Landscape

To counter the growing threat landscape and mitigate losses, the crypto industry must prioritize the following:

- Implement AI-Powered Security: Utilize AI-powered risk assessment, transaction validation, and anomaly detection tools to identify and prevent malicious activities.

- Deploy Robust Detection and Prevention Systems: Develop and implement robust detection and prevention systems, integrating them with crisis response mechanisms.

- Enhance Private Key Management: Improve private key management practices through robust protocols and secure storage solutions.

- Real-Time Monitoring: Implement real-time threat monitoring solutions to detect and respond to zero-day attacks promptly.

- Foster Greater Collaboration: Encourage greater collaboration between stakeholders to share threat intelligence and best practices.

- Strengthen Regulatory Frameworks: Develop robust regulatory frameworks that address the specific security challenges in the crypto industry.

- Prioritize Cybersecurity Education: Improve cyber hygiene of firms with training and awareness programs.

- Improve Incident Reporting: Prioritize data reporting and collection of cyber incidents to enhance collective preparedness.

Conclusion

The crypto industry cyber threat impact, $2.3B loss 2024, serves as a critical wake-up call for the entire cryptocurrency ecosystem. The persistent vulnerabilities and evolving attack methods underscore the need for a proactive and comprehensive approach to cybersecurity. As the crypto industry continues to grow, only through a concerted effort to improve security measures, foster collaboration, and adopt advanced technologies can it hope to safeguard user funds and maintain trust in the digital asset space. The losses sustained in 2024 demonstrate that reactive measures are no longer sufficient; a proactive and robust security posture is essential for the future of the crypto industry.

SEC Accounting Bulletins on Digital Assets: SAB 121 and SAB 122

Explore the complexities of SEC's Staff Accounting Bulletins 121 and 122, their impact on crypto custody, and the pushback from the financial industry and Congress. Learn about the ongoing debate on digital asset regulation.

Published Jan 23, 2025

Understanding the Collectibles Landscape: Baseball Cards, Stamp Paper, and the Rise of Trump Coin

Explore the world of collectibles, from baseball cards and stamp paper to the digital Trump Coin. Compare market dynamics, investment potential, and unique characteristics.

Published Jan 23, 2025

The Potential for a USA Digital Asset Stockpile: Exploring the Future of Cryptocurrency Reserves

Explore the potential of a USA digital asset stockpile, examining Trump's evolving stance, legislative initiatives, benefits, challenges, and the role of a crypto working group.

Published Jan 23, 2025